Covered California Renewal 2026: Central California Guide with Quote Valley Insurance

Every year, California residents face an important decision — whether to renew, update, or switch their health insurance through Covered California. As the Covered California renewal 2026 season approaches, changes to premiums, subsidies, and federal rules make this one of the most critical years to review your options. At Quote Valley Insurance of Central California, our goal is to simplify the renewal process and ensure you get the right coverage at the most affordable rate.

What Does Covered California Renewal Mean?

A California health insurance renewal allows you to keep your current plan or make adjustments for the upcoming year. If you take no action, most households will be automatically re-enrolled in their existing plan — but that may not always be the best option.

Renewal season is the time to:

- Update your income and household information.

- Compare new plan options for 2026.

- Check if you qualify for subsidies or additional savings.

- Switch to a plan that better matches your doctors, hospitals, and budget.

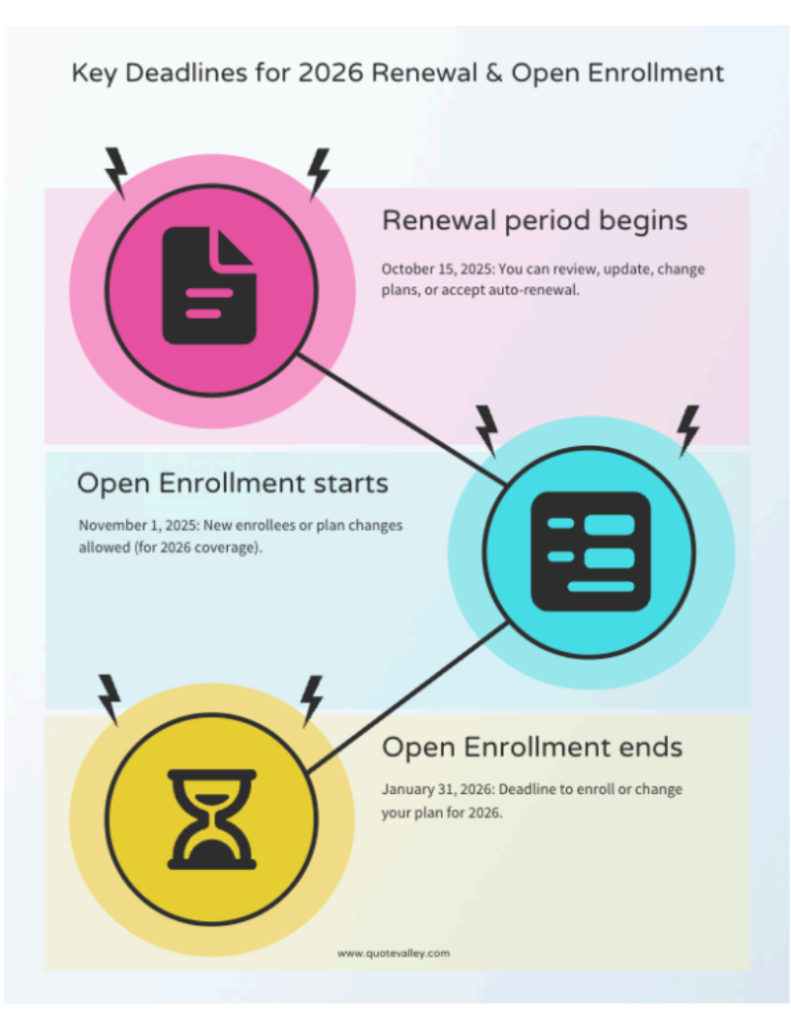

The Covered California renewal 2026 period begins October 15, 2025, giving you the opportunity to review your coverage before the Covered California open enrollment 2026 officially starts on November 1, 2025. Open enrollment closes on January 31, 2026, which is the final deadline to secure coverage for the year.

Important Dates for Covered California Open Enrollment 2026

Missing these dates could mean losing coverage unless you qualify for a special enrollment period due to a life event.

What to Expect: Rates and Subsidies in 2026

Health insurers in California have already projected average premium increases of 10.3% for Rising healthcare and prescription drug costs drive much of this increase. But the bigger concern is the possible expiration of enhanced federal subsidies at the end of 2025.

- Without Congressional action, many families may see their net premiums increase by more than 60%.

- The State of California has pledged $190 million to extend limited subsidies, but that will only cover part of the gap.

- On the positive side, certain Bronze and minimum coverage plans will qualify as High Deductible Health Plans (HDHPs), allowing members to open a Health Savings Account (HSA).

At Quote Valley Insurance, a trusted Covered California health insurance agency, we’ll help you estimate costs and identify ways to reduce your premiums by taking advantage of every available subsidy.

Policy Changes to Watch for 2026

Several policy shifts will impact the renewal process this year:

- Stricter income verification – Self-attested income may no longer be accepted if tax data isn’t available.

- Limits on subsidies – Some rules may restrict premium tax credits for those enrolling without a qualifying life event.

- Auto-renewal uncertainty – While most members will be auto-renewed in 2026, future rules may phase out automatic enrollment.

- Potential shorter enrollment windows – 2027 may see a compressed open enrollment period (Nov. 1 – Dec. 31).

These changes make it more important than ever to work with a Covered California certified agent who can guide you through updates and documentation requirements.

How Central California Families Can Prepare

Here’s how you can get ready for Covered California renewal 2026 with the help of Quote Valley Insurance:

- Update your household details early – Log in before October 15 to ensure your income, dependents, and address are accurate.

- Compare plans using professional guidance – Don’t rely on auto-renewal. Our agents can help you use the Shop & Compare tool and weigh costs versus coverage.

- Check provider networks – Ensure your preferred doctors and hospitals remain

- Plan for higher premiums – Review options such as switching tiers (Silver to Bronze) or adjusting deductibles.

- Stay informed on federal decisions – Subsidy changes could directly impact your bottom line.

- Work with a local agent – A Covered California certified agent in Central California can walk you through the process, explain changes, and ensure you don’t miss deadlines.

What Happens If You Do Nothing?

If you don’t take action, Covered California may automatically renew your plan, but:

- You could face unexpected premium increases.

- Subsidy eligibility might change without updated income details.

- You may remain in a plan that no longer fits your health needs.

Why Choose Quote Valley Insurance?

At Quote Valley Insurance, we’re more than just a Covered California health insurance agency. We’re part of the Central Valley community — serving Fresno, Tulare, Kings, and surrounding counties. Our mission is to provide personalized, face-to-face guidance so families and individuals can make confident health insurance choices.

As a Covered California certified agent, we’ll:

- Walk you through the entire Covered California open enrollment 2026 process.

- Help you understand premium changes, subsidies, and plan networks.

- Ensure your renewal is completed correctly and on time.

Final Thoughts

The Covered California renewal 2026 season is one of the most important in recent years due to rising costs and policy uncertainty. The good news is that with proactive preparation and the support of a Covered California certified agent at Quote Valley Insurance, you can protect your health coverage, reduce financial stress, and choose a plan that works for your family.